Employee Fraud Prevention Software To Detect & Stop

Insider Fraud

Teramind’s employee fraud prevention platform detects fraudulent activity, prevents financial fraud, and protects company assets through behavioral monitoring and real-time threat detection and blocking of malicious actions.

Trusted by 10,000+ organizations to improve productivity, security, compliance, and workforce analytics.

Why Choose Teramind for Employee Fraud Prevention

Detect Employee Fraud Before Incidents Occur

Our fraud prevention software monitors employee behavior to identify warning signs of potential fraud. Detect suspicious activity patterns that indicate expense reimbursement fraud, asset misappropriation, or attempts to misuse company assets for personal gain.

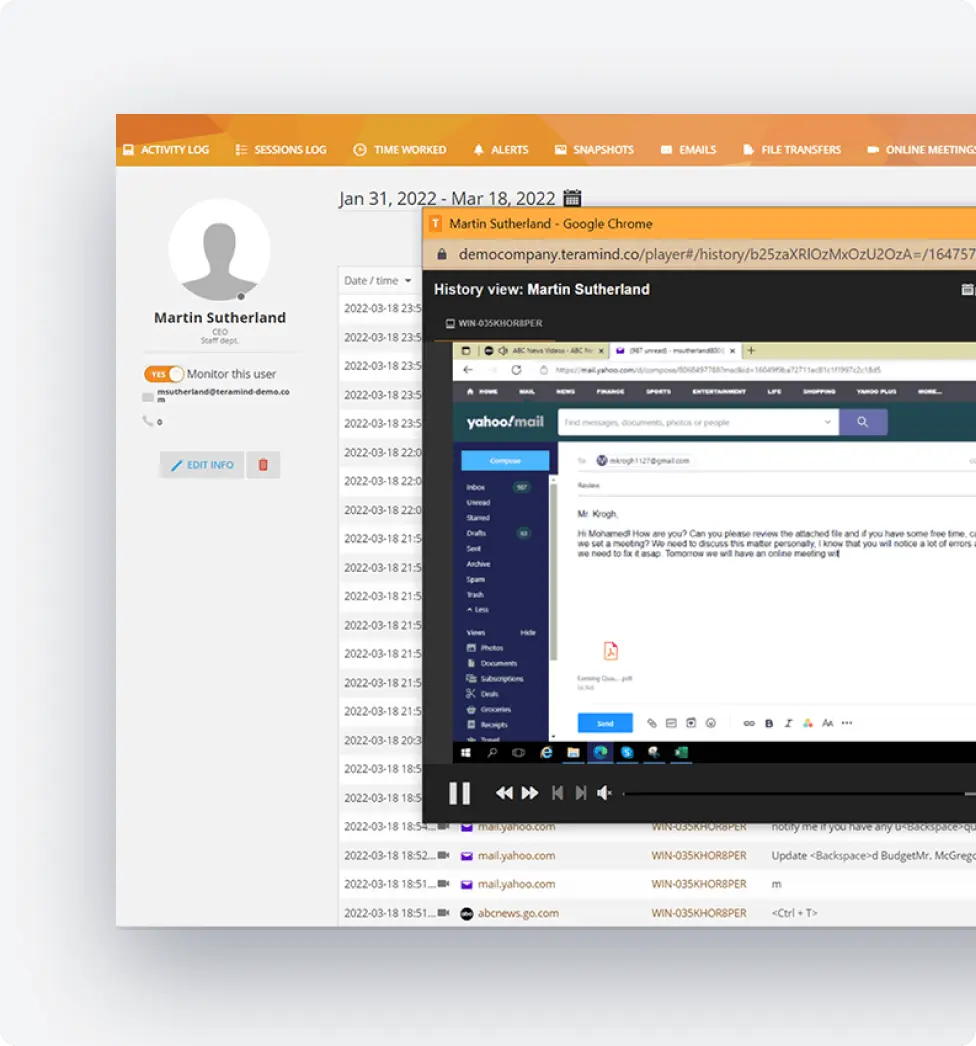

Irrefutable & Court-Admissible Video Recordings & Logs

Our software captures screen recordings and activity logs that serve as court-admissible evidence. Document every action when employees commit fraud, from fake invoices to unauthorized transfers. This forensic-quality evidence supports investigations and protects organizations during legal proceedings.

Behavioral Analytics Reveal Hidden Fraud Schemes

Traditional internal controls miss sophisticated fraud schemes. Our behavioral monitoring detects when employees manipulate systems, create fake invoices, or attempt to divert money to personal accounts by analyzing actual work patterns and identifying anomalies.

Core Teramind Features for Employee Fraud Prevention

Our employee fraud prevention platform combines real-time monitoring, screen recodings, behavioral analytics, and comprehensive reporting to protect against internal fraud.

Financial Fraud Detection

Monitor activities that indicate financial fraud:

- Detect attempts to create fake invoices or manipulate billing systems

- Track access to accounts payable and financial records

- Monitor suspicious changes to vendor information or bank accounts

- Identify expense fraud through unusual submission patterns

- Alert on attempts to access payroll system inappropriately

Asset Protection and Theft Prevention

Prevent employee theft and asset misappropriation:

- Monitor access to company assets and inventory systems

- Detect potential inventory theft through behavioral patterns

- Track misuse of company resources for personal expenses

- Automatically block malicious actions and takeover remote desktops when incidents occur

- Monitor printing and exporting of sensitive financial data

Intellectual Property Protection

Safeguard against intellectual property theft:

- Track access to proprietary information and trade secrets

- Monitor file transfers that could indicate data theft

- Detect attempts to copy sensitive data to personal devices

- Alert on unusual access patterns to confidential information

- Create audit trails for all intellectual property access

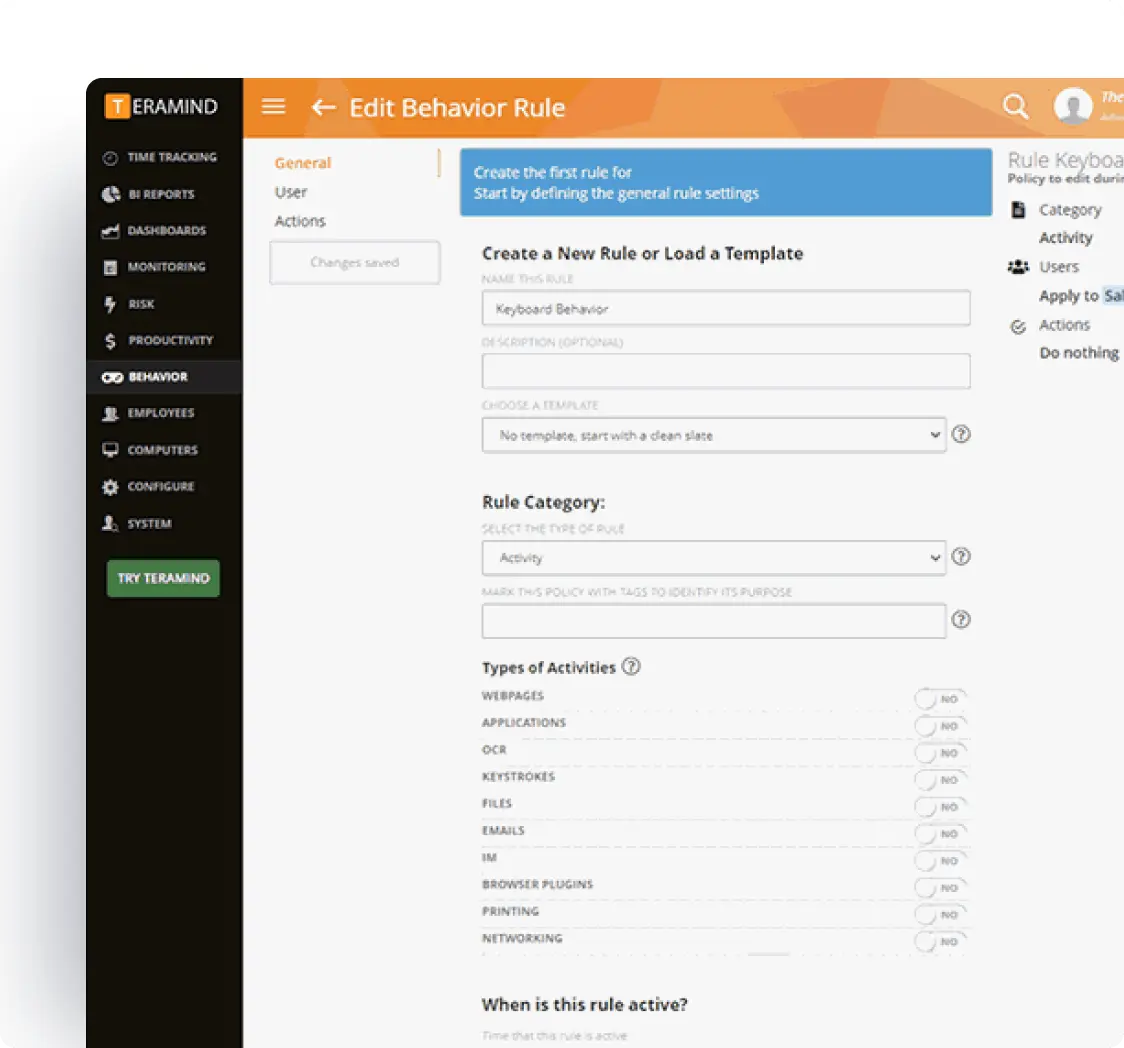

Behavioral Analytics for Fraud Detection

Identify fraudulent behavior through pattern analysis:

- Detect anomalies in employee work patterns suggesting fraud

- Monitor for collusion between employees in fraud schemes

- Identify attempts to hide fraudulent activities

- Track suspicious after-hours access to financial systems

- Use machine learning to improve fraud detection accuracy

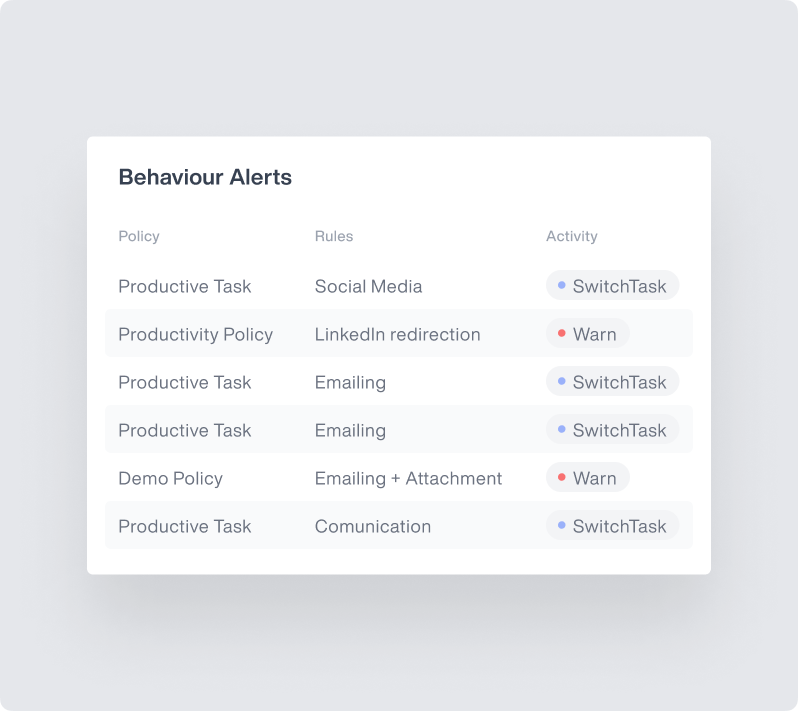

Real-Time Alerts and Response

Stop fraudulent activity as it happens:

- Get instant alerts when employees access sensitive financial records

- Monitor unusual activity in accounts payable systems

- Track attempts to modify vendor or customer data

- Alert on suspicious expense claims patterns

- Enable quick fraud response plan activation

Comprehensive Audit and Compliance

Support fraud investigations with detailed evidence:

- Generate forensic reports for fraud investigations

- Maintain immutable logs of all employee activities

- Document internal controls compliance

- Create evidence trails for legal repercussions

- Support certified fraud examiners with detailed data

Enterprise Integrations

Integrate Teramind with your existing infrastructure to enhance fraud prevention.

- Integrate with leading SIEM solutions like Splunk, ArcSight, and QRadar to centralize security event monitoring

- Connect with SOAR platforms to automate incident response for potential data privacy violations

- Leverage Common Event Format (CEF) for standardized security event reporting

- Enhance existing security tools with Teramind’s detailed user behavior analytics

Arrivia Stopped an Insider Data Theft Ring

with Teramind

Learn how a leading travel company used Teramind to detect and prevent employee fraud and ensure compliance with federal regulations while building legally defensible evidence for any violations.

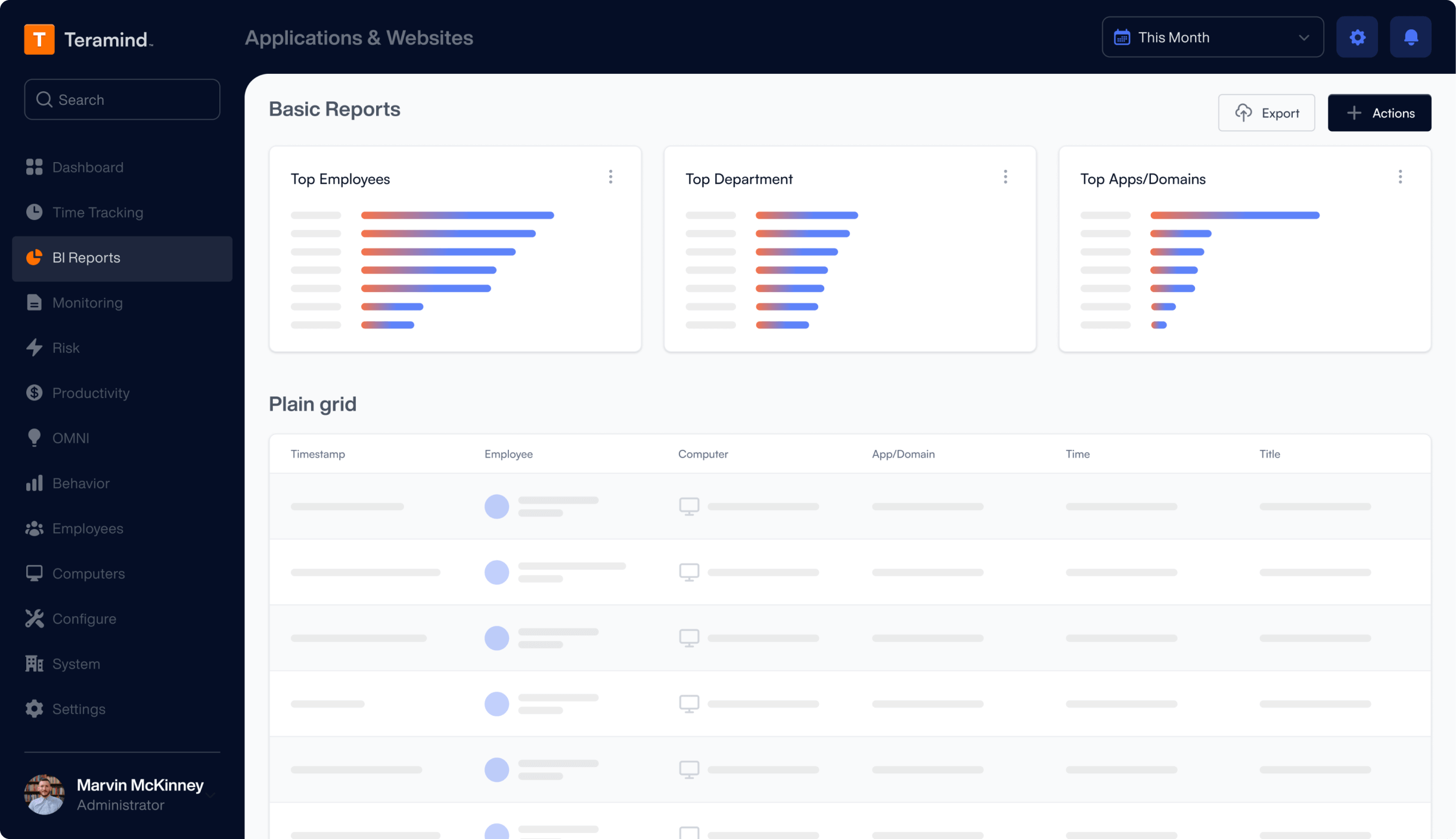

Teramind's Core Features

Leverage Teramind’s unparalleled power to solve your workforce challenges.

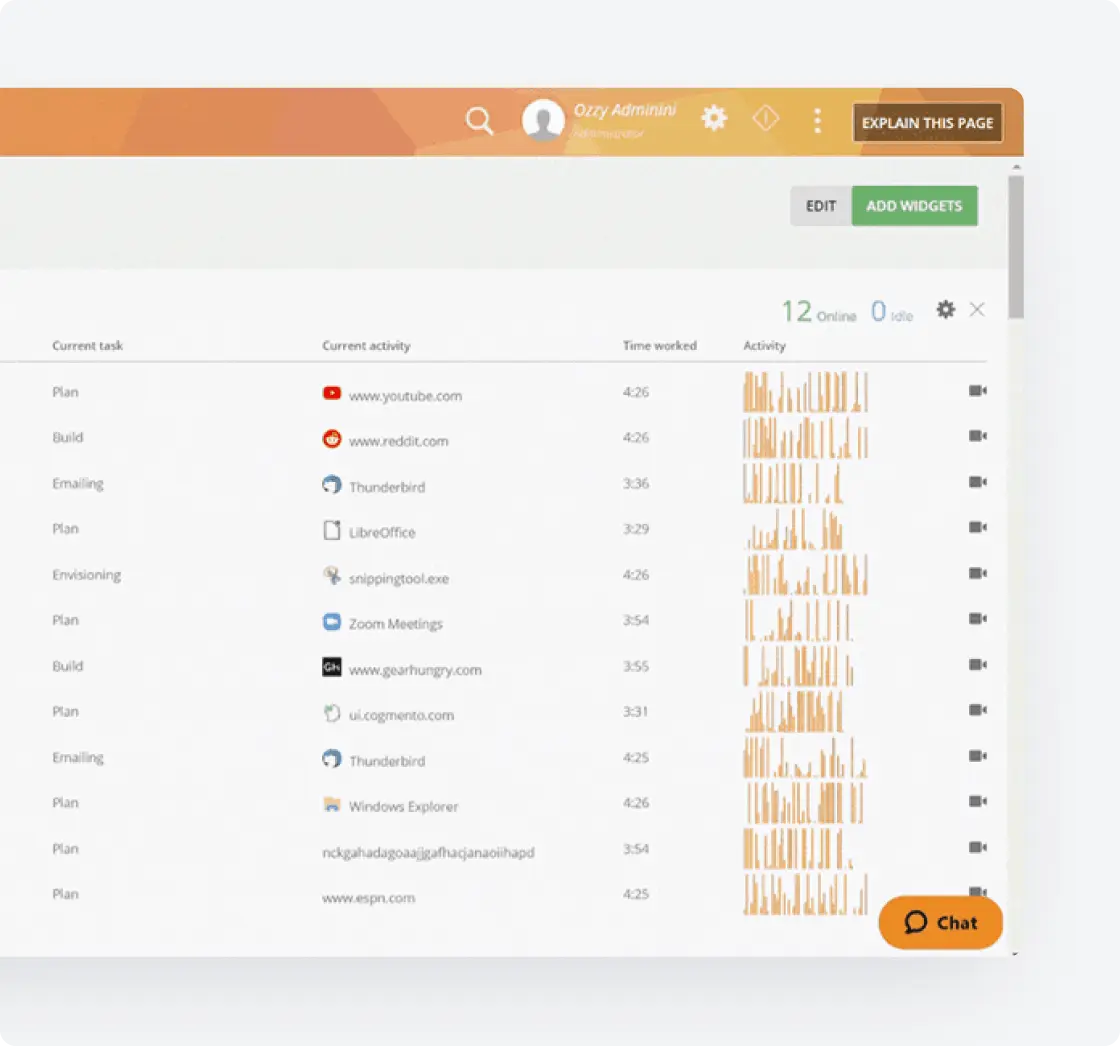

Live View & Historical Playback

Monitor employee screens in real-time or review past activity with historical playback to gain complete visibility into user activity and computer activity.

Optical Character Recognition

Teramind’s OCR functionality allows you to extract text from images and screenshots, enhancing your monitoring and analysis capabilities.

Website

Monitoring

Track employee time spent on websites, identify unproductive web browsing, and enforce company policies with comprehensive website monitoring.

Application

Monitoring

Monitor application usage, track time spent on specific apps, and identify potential security risks with detailed application monitoring on your endpoints.

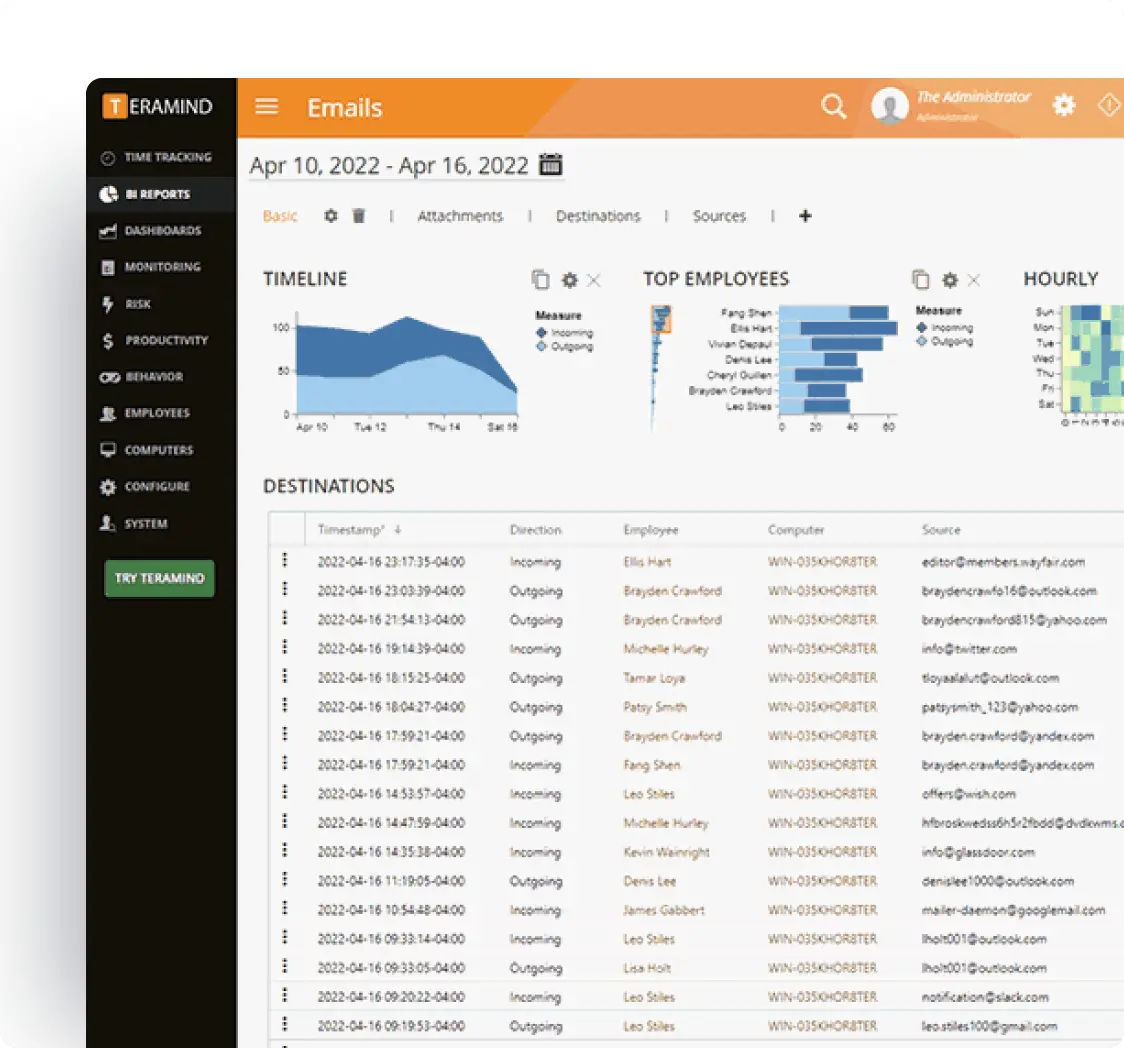

Email

Monitoring

Monitor employee emails to prevent data leaks, ensure compliance with company policies, and protect sensitive information.

Instant Message Monitoring

Track instant messages and conversations to gain insights into team communication and collaboration, and ensure compliance.

Social Media Monitoring

Monitor social media activity to protect your brand reputation, prevent data leaks, and ensure employees adhere to company policies.

Network

Monitoring

Gain visibility into network activity, identify potential security threats, and optimize network performance with network monitoring.

Citrix

Monitoring

Monitor employee activity within Citrix environments, track application usage, and ensure data security with specialized Citrix monitoring on your devices.

Remote Desktop Control

Take control of remote employee computers in real-time to provide support, troubleshoot issues, or prevent data breaches and insider threats.

RDP Session Recording

Record RDP sessions to gain a comprehensive understanding of user activity, troubleshoot technical problems, and ensure compliance.

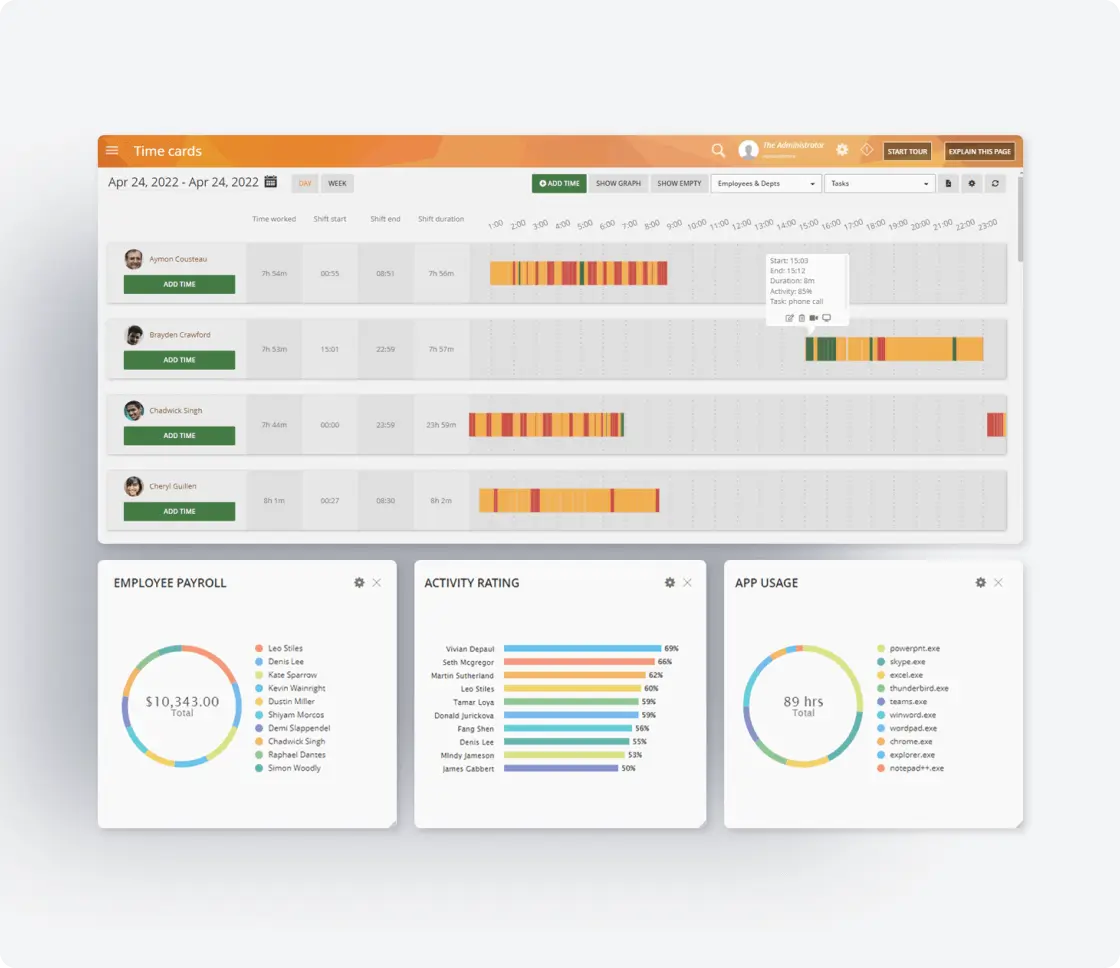

Productivity

Analysis

Analyze employee productivity with detailed metrics, identify areas for improvement, and boost productivity across your team members.

Active Vs. Idle

Time Logs

Track active and idle time to understand how employees spend their work hours and optimize time management and productivity.

Unproductive Work

Time Analysis

Identify unproductive work time, analyze patterns, and implement strategies to improve efficiency and time management.

Try a Live Demo

of Teramind

Interact with a live deployment of Teramind

to see how our platform works.

What our Customers Say

“The interface and reporting capabilities of Teramind remain unmatched compared to other products we have tried. Overall, Teramind is far more advanced than other competitors. They are definitely raising the bar and I’ll back them up any day.”

Ricky H.

Government Administration

“It’s been an amazing experience and a wonderful software that does exactly what you want! Security, control, peace of mind, the ability to know all that is going on in the organization. Very easy to use. It gives you real data! It has given us the protection that we need!”

Rene H.

Head IT Security

“This software has allowed us to save from a potential data breach and being able to catch people leaving who tried to take our IP. Very good software. A bit on the expensive side but worth every penny. Functionality is easy to get around. Has a great GUI.”

Milena L.

IT Manager

FAQs

What are the most common types of employee fraud that software can detect?

Employee fraud prevention software helps detect various fraud types including expense reimbursement fraud (submitting false expense claims), billing fraud (creating fake invoices or vendor fraud), payroll fraud (timesheet fraud or ghost employee schemes), and asset misappropriation (employee theft of company resources). The software monitors for warning signs like unusual access patterns, suspicious financial transactions visible on screen, attempts to modify financial records, or data indicating someone trying to divert money for personal gain.

How does behavioral monitoring help prevent employee fraud?

Behavioral monitoring establishes normal patterns for how employees interact with financial systems and company assets. When someone commits fraud, their behavior typically changes - accessing systems at unusual times, viewing financial statements they don't need, or attempting to hide liabilities. By detecting these anomalies, behavioral analytics can identify potential fraud before significant losses occur. This approach catches sophisticated schemes that bypass traditional internal controls.

Can employee fraud prevention software prevent insider fraud without impacting employee morale?

Yes, effective fraud prevention focuses on protecting company resources rather than creating a surveillance culture. Implement role based access controls that limit opportunities for fraud, use transparent policies that encourage employees to report suspicions, and focus monitoring on high-risk activities involving company funds or sensitive data. When employees understand that fraud prevention protects everyone's financial well being and job security, they typically support these measures.

What should organizations do when fraud detection software identifies suspicious activity?

When detecting potential fraud, organizations should follow their fraud response plan which typically includes: immediately preserving evidence from the monitoring system, conducting preliminary risk assessment to determine severity, engaging appropriate stakeholders (legal, HR, certified fraud examiners), investigating while maintaining confidentiality, and taking action based on findings. The software provides detailed logs and evidence for fraud investigations, helping establish facts before confronting employees or taking legal action.